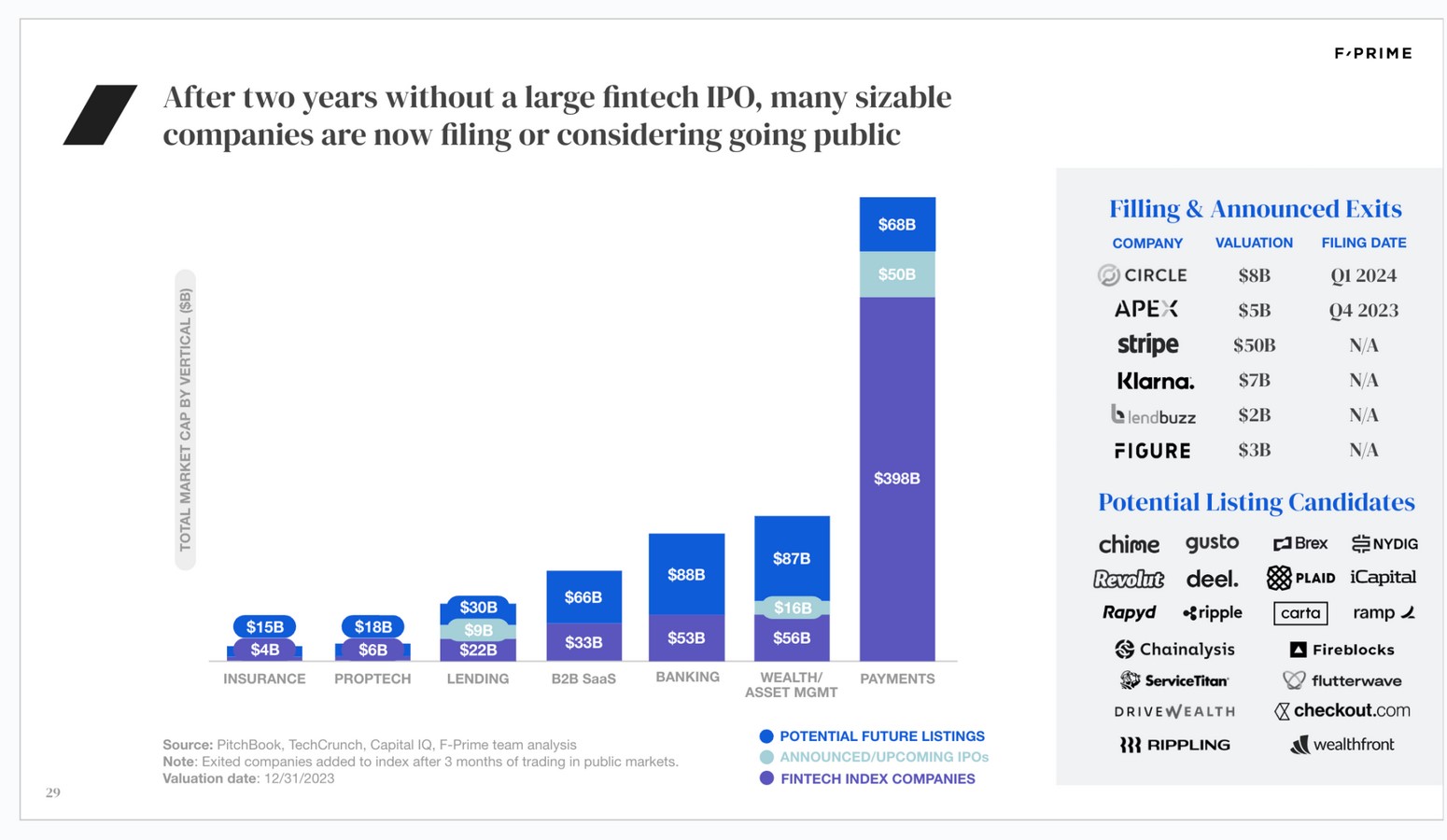

Could 2024 witness a surge in fintech IPOs? According to F-Prime Capital’s State of Fintech 2024 report, the answer is a resounding yes. F-Prime Capital, a venture capital firm managing over $4.5 billion in assets, remains optimistic about the fintech sector’s growth trajectory. Highlighting that fintech companies currently capture less than 10% of financial services revenue, F-Prime sees significant potential for scaled private fintech firms generating over $1 billion in revenue to make their public market debut.

Evaluating Prospective IPO Candidates

Several notable fintech companies are considering or actively preparing for IPOs in 2024. Among them is Apex, a stock trade clearance firm, which, after an unsuccessful attempt via a SPAC merger, is now exploring a direct SEC filing to go public. Similarly, Klarna, a Swedish fintech giant, has taken initial steps towards an IPO, including a legal entity restructuring to facilitate listing on stock exchanges. Lendbuzz, specializing in AI-driven auto loans, is also reportedly gearing up for an IPO that could value the company at over $2 billion.

Stripe’s Ambiguous Path

Despite earlier speculation about an imminent IPO, Stripe, a leading payments platform, has remained silent about its plans. Last year, Stripe raised significant funding, reaffirming its position as one of the most valuable privately held fintech companies globally. While the company continues to expand its product offerings and acquisitions, its IPO timeline remains uncertain.

Challenges and Opportunities

Chime, a neobank once valued at $25 billion, has faced setbacks amid market volatility and organizational restructuring. Despite a decline in valuation and layoffs, Chime remains a potential IPO candidate. Similarly, Plaid, a financial data connectivity platform, has made strategic hires indicating a possible IPO in the future, although no official timeline has been disclosed.

The HR Tech Landscape

Rippling, Gusto, and Deel, prominent players in the HR tech space, have garnered attention for their rapid growth and market competitiveness. While Rippling secured significant funding, Gusto reported impressive revenue figures, and Deel experienced exponential growth in annual recurring revenue. As competition intensifies, these companies are positioning themselves for future growth opportunities, potentially including IPOs.

Navigating Market Dynamics

In the spend management sector, companies like Brex, Ramp, and Navan are vying for market dominance. While Navan has taken steps towards an IPO, others are focused on optimizing operations and minimizing cash burn. Despite challenges such as layoffs and valuation fluctuations, these companies remain committed to their long-term goals, which may include going public when the time is right.

Conclusion

The fintech landscape is ripe with opportunities for companies to make their mark on the public markets in 2024. With investors showing confidence in the sector’s growth potential, prospective IPO candidates are navigating market dynamics and strategic decisions to position themselves for success in the evolving financial technology landscape. As the year unfolds, the fintech industry awaits eagerly to see which companies will take the leap into the public markets and redefine the